Organizations and investment managers operating in dynamic markets must balance competing demands: the need to extract value from existing assets, to adapt and defend market position amid near-term disruptions, and to pursue novel opportunities that will sustain long-term growth. The three-horizon framework, originally articulated as a strategic innovation model and subsequently adapted for portfolio management, offers a structured approach to allocating capital, capabilities, and managerial attention across time horizons. When applied to financial or corporate portfolios, the three-horizon approach clarifies trade-offs among risk, return, and optionality while enabling disciplined decision-making that aligns with organizational objectives and market realities.

This article presents a comprehensive and formal exposition of three-horizon portfolio planning. It covers the framework’s conceptual foundations, practical implementation steps, governance considerations, measurement and metrics, risk management implications, and typical pitfalls with mitigation strategies. The objective is to provide practitioners—asset managers, corporate strategists, and senior executives—with a rigorous yet practical guide for adopting a time-phased portfolio approach that supports sustained value creation.

Conceptual Foundations

Origins and Rationale

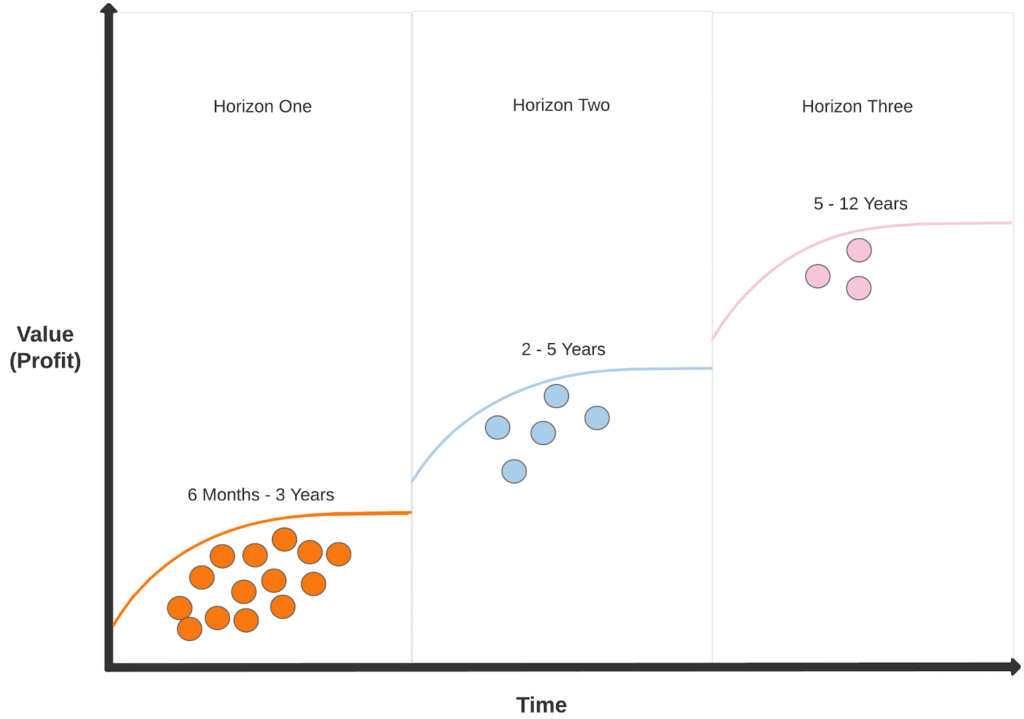

The three-horizon model was popularized by McKinsey & Company in the context of corporate innovation and growth. It partitions strategic initiatives into three temporal horizons:

- Horizon 1 (H1): Core business activities that generate current cash flow and require incremental improvements to sustain competitiveness.

- Horizon 2 (H2): Emerging business opportunities that are scaling and have the potential to become significant future contributors but are not yet core.

- Horizon 3 (H3): Long-term, high-uncertainty options, exploratory initiatives, or disruptive bets that may reshape the organization’s future.

Rationale for Portfolio Thinking

Investing exclusively in H1 preserves short-term performance but risks obsolescence. Overweighting H3 enhances future optionality but jeopardizes near-term viability. Three-horizon portfolio planning reframes the decision problem as an allocation of scarce resources (capital, talent, time) across horizons to optimize a combination of current returns, growth potential, and strategic resilience.

Key Principles

- Temporal diversification: Treat time as an axis for diversification, akin to sector or geographic diversification in financial portfolios.

- Intentional allocation: Define explicit targets for resource distribution across horizons that reflect strategy, risk tolerance, and lifecycle stage.

- Stage-appropriate governance: Align oversight, metrics, incentives, and risk controls to the maturity of initiatives within each horizon.

- Portfolio dynamics: Accept that rebalancing will be required as initiatives mature, succeed, or fail; maintain mechanisms to move initiatives across horizons or to exit.

Structure and Characteristics of Each Horizon

Horizon 1 — Defend and Extend the Core

Characteristics

- Low-to-moderate risk; high certainty relative to other horizons.

- Predictable revenue and cost structures.

- Emphasis on efficiency, process improvements, scale benefits, and customer retention.

Investment Objectives - Protect cash flow and market position.

- Fund incremental innovation that sustains profitability.

Management and Metrics - KPIs: EBITDA margin, revenue growth rate, customer churn, operating efficiency metrics, ROI on incremental investments.

- Governance: Traditional management structures with rigorous performance management and defined budget cycles.

Horizon 2 — Build Emerging Businesses

Characteristics

- Moderate risk; uncertain but with identifiable customer segments and value propositions.

- Requires investment to scale and prove repeatability.

Investment Objectives - Capture adjacent markets, apply core assets to new use cases, and convert promising experiments into profitable lines.

Management and Metrics - KPIs: Unit economics (LTV/CAC), scale-up burn rates, adoption rates, revenue contribution trajectories, time-to-break-even.

- Governance: Dedicated growth teams, product-market fit milestones, stage-gate funding tied to metrics rather than fixed budgets.

Horizon 3 — Create New Options and Disruptive Innovation

Characteristics

- High risk and high uncertainty; outcomes are deeply uncertain.

- Focus on exploration, discovery, and optionality rather than immediate profitability.

Investment Objectives - Generate strategic options, advance frontier research or unproven business models, and shape long-term competitive architecture.

Management and Metrics - KPIs: Learning velocity, validated hypotheses, technology readiness levels, potential market size (TAM) if realized.

- Governance: Autonomous teams, tolerance for experimentation and failure, small, time-boxed investments to reduce sunk-cost bias.

Implementation: Designing a Three-Horizon Portfolio

Step 1: Define Strategic Objectives and Constraints

Begin by articulating the organization’s strategic goals (growth targets, risk tolerance, regulatory constraints, shareholder expectations). Determine the planning horizon (e.g., 1–3 years for H1, 3–7 years for H2, 7+ years for H3) that fits the business model and industry dynamics.

Step 2: Inventory Existing Initiatives and Assets

Map current projects, product lines, and investments into the three horizons based on maturity, revenue contribution, uncertainty, and strategic intent. This inventory facilitates transparency and highlights concentration risks that may require corrective reallocations.

Step 3: Set Allocation Targets and Ranges

Establish explicit allocation ranges for capital, talent, and management attention across horizons. Typical allocations vary by sector and corporate lifecycle:

- Mature companies: H1 heavy (e.g., 70/20/10 or 60/30/10) to defend cash flows while funding growth bets.

- Growth-stage firms: Larger H2 allocation (e.g., 50/40/10) to scale emerging businesses.

- Research-driven organizations: Higher H3 allocation (e.g., 40/30/30) to maintain technological leadership.

These numbers are illustrative; the guiding principle is to set allocations that balance short-term viability with long-term optionality.

Step 4: Establish Funding Mechanisms and Stage-Gates

Adopt differentiated funding mechanisms:

- H1: Operational budgeting with ROI thresholds and efficiency targets.

- H2: Milestone-based scaling funds tied to customer traction and unit economics.

- H3: Option-like seed funding, research grants, experimentation budgets with predefined learning objectives.

Implement stage-gate criteria for transitioning initiatives between horizons (e.g., H3 → H2 when product-market fit is demonstrated; H2 → H1 when repeatable margins and processes exist).

Step 5: Design Governance and Incentives

Create governance structures that reflect the distinct needs of each horizon:

- H1 governance emphasizes operational controls, performance accountability, and incremental KPIs.

- H2 governance requires entrepreneurial leadership, iterative assessment, and flexible resourcing.

- H3 governance favors autonomy, research-minded metrics, and executive sponsorship to protect long-term bets.

Align incentives: avoid rewarding short-term metrics for teams responsible for long-term options. Use differentiated performance metrics and career paths to encourage behaviors appropriate to each horizon.

Step 6: Monitoring, Rebalancing, and Exit Protocols

Institute recurring portfolio reviews (quarterly or semi-annual) that evaluate progress against horizon-specific KPIs and reallocate capital as warranted. Define clear exit protocols to terminate initiatives that fail to meet milestones or that show poor forward optionality, thereby freeing resources for higher-probability opportunities.

Measurement and Metrics

Appropriate metrics differ by horizon and should be designed to measure the right objectives—not to force long-term initiatives onto near-term financial metrics that will distort behavior. Examples:

H1 metrics:

- Revenue, margin, cost per unit, ROI, customer retention, incremental profit.

H2 metrics:

- Customer acquisition cost, lifetime value ratios, churn among early adopters, scale-up burn rates, unit economics improvement over time.

H3 metrics:

- Number of validated hypotheses, prototypes built and tested, technology readiness advancement, strategic value estimates (scenario-based), learning per dollar invested.

Portfolio-level metrics:

- Allocation percentages across horizons.

- Expected cash-flow profile and sensitivity analysis.

- Option value estimations (real options analysis) for H2/H3 investments.

- Diversification and concentration measures (industry, geography, technology exposure).

Risk Management Considerations

Systemic and Horizon-Specific Risks

- Concentration risk: Overexposure to H1 may leave the organization vulnerable to disruption; overexposure to H3 can strain liquidity.

- Execution risk: H2 and H3 initiatives face execution complexity, capability gaps, and uncertainty in scaling.

- Resource crowding: Talent and capital constraints can force suboptimal trade-offs; ensure no horizon is starved of critical resources.

- Behavioral risk: Misaligned incentives can bias management toward short-term outcomes.

Mitigation Strategies

- Liquidity planning: Maintain sufficient buffer in H1 cash flows to support experimental activity without imperiling operations.

- Capability building: Invest in skills (e.g., product management, experimentation, deep R&D) needed to execute across horizons.

- Scenario planning: Stress-test portfolios under plausible disruptive scenarios and perform sensitivity analysis on key assumptions.

- Governance safeguards: Use separate but coordinated decision forums to protect long-term bets from short-term performance pressure.

Advanced Topics

Real Options Valuation

For H2 and H3 initiatives, consider applying real options theory to value investments that create optionality rather than immediate cash flows. Techniques such as binomial trees or Monte Carlo simulation can quantify the value of staged investments and the option to defer, expand, or abandon projects.

Portfolio Optimization Under Uncertainty

Incorporate stochastic models and scenario analysis to optimize allocations under uncertainty. Use utility functions that reflect managerial risk preferences and strategic constraints to guide allocations rather than purely maximizing expected financial return.

Integration with Capital Markets and External Fundraising

For firms that can access external capital markets, horizon planning interacts with financing choices. H3 investments may be financed via strategic partnerships, corporate venture funds, or external equity to mitigate dilution of core balance-sheet resources. Align investor communications to explain allocation rationale and the long-term value proposition.

Common Pitfalls and Remedies

Pitfall: Treating horizons as silos

Remedy: Encourage cross-horizon knowledge transfer and create pathways for scaling successful H3 experiments into H2 and H1 structures.

Pitfall: Applying H1 metrics to H3 projects

Remedy: Define horizon-specific KPIs and reporting cadences; educate stakeholders on appropriate expectations for learning-focused initiatives.

Pitfall: Insufficient governance for long-term bets

Remedy: Provide executive sponsorship and protected funding for H3, with clearly articulated milestones and review mechanisms to ensure accountability.

Pitfall: Overly rigid allocation targets

Remedy: Use allocation ranges, not fixed quotas. Allow for tactical deviations when justified by evidence, but require governance-level approval for material shifts.

Pitfall: Failing to build capabilities to scale H2 initiatives

Remedy: Incorporate capability-building initiatives into the portfolio (e.g., platform investments, talent development) and treat them as enablers rather than optional expenditures.

Case Examples (Illustrative)

- Large Consumer Goods Company

- H1: Optimize supply chain, reduce SKU complexity, and improve merchandising for core brands.

- H2: Invest in adjacent health-focused product lines that leverage distribution capabilities.

- H3: Fund long-term research into sustainable packaging or alternative formulations that could redefine product categories.

- Technology Firm

- H1: Maintain core software subscriptions and improve customer success operations.

- H2: Scale a cloud-native product that targets a new vertical market with proven pilots.

- H3: Invest in platform-level research (e.g., AI or quantum-related prototypes) with small, protected labs and venture-style funding.

- Asset Manager

- H1: Maintain core public market strategies focused on efficient beta and traditional alpha generation.

- H2: Seed and scale new active strategies (e.g., thematic or sector-focused funds) with differentiated alpha potential.

- H3: Commit a small portion of capital to venture-style or alternative investments to access asymmetric returns and optionality.

Conclusion

Three-horizon portfolio planning is not a prescriptive formula but a disciplined mindset and set of practices that help organizations navigate the tension between present performance and future relevance. By consciously allocating capital, capabilities, and managerial attention across horizons, organizations can protect current value, cultivate emerging opportunities, and preserve the optionality necessary for long-term transformation.

Successful implementation requires clear strategic intent, honest assessment of current initiatives, stage-appropriate governance and metrics, and a disciplined process for funding, monitoring, and rebalancing. Executives who institutionalize these practices foster both resiliency and agility—ensuring that the organization can perform today while shaping the industries of tomorrow.

Suggested Next Steps for Practitioners

- Conduct a horizon-mapping exercise for all active projects and product lines.

- Define allocation ranges and adopt stage-gate criteria for movement between horizons.

- Create or adapt governance forums with distinct charters for each horizon.

- Implement horizon-specific KPIs and reporting cadences.

- Run scenario analyses to stress-test the portfolio under disruptive market conditions.

By translating strategy into explicitly managed horizons, organizations can steward resources more effectively, align incentives with long-term goals, and create a repeatable process for discovering and scaling the next generation of value drivers.

Discover more from Decroly Education Centre - DEDUC

Subscribe to get the latest posts sent to your email.